The procedure however is subject to information given in ITRF as well as the submission of supporting documents if required for review. Many of the above often occur in companies which do not have a designated tax team or structure to manage tax matters or communication from authorities.

St Partners Plt Chartered Accountants Malaysia What Lhdn Proposing The Tax Credit Contra With Future Tax Instalments Shall We Accept Shall We Insist Lhdn Refund The Tax

The Tax Refund Form is valid 2 months from the date of Customs validation.

. At present the RMCD is expected to conduct GST audit on businesses expecting a refund. Available in Bahasa Malaysia only. Minister Tengku Datuk Seri Zafrul Abdul Aziz said the payment process would be completed by December this year.

Set out below is a summary of the announcement and the FAQs-. Here is a step-by-step guideline that can help you to register GST and understand the tax system. Overview of Goods and Services Tax GST GST is a multi-stage tax on domestic consumption.

Refund will be made to the claimant within 14 working days if the claim is submitted online or 28 working days if the claim is submitted. Visit your Customs office in person to follow up. Amendments to the final GST-03 return if any must be made by 31 August 2020.

Be approved by the Royal Malaysian Customs Department to participate in the scheme. The excess amount of output tax shall be remitted to the. Businesses have to charge and collect GST on all taxable goods and services supplied to the consumers.

Any refund of tax may be offset against other unpaid GST customs and excise duties. ON Jan 2 the Finance Minister wrote an op-ed in the StarBizWeek which amongst other things talked about the government executing its Medium-Term Revenue Strategy. Prior to the implementation of GST Royal Malaysian Customs Department RMCD collects sales tax from companies on certain imported and locally manufactured goods under the Sales Tax Act 1972 STA.

As an initiative to expedite the GST refund process to ease the cash flow burden of businesses the pay first and audit later approach will be adopted. A recent decision by Malaysias High Court in LDMSB vKetua Pengarah Kastam Anor 17 June 2021 unreported as yet allowed the taxpayer LDMSB a refund of an input tax credit ITC in relation to the former goods and services tax GST as a refund of tax overpaid or erroneously paid The High Court decision is potentially controversial as claiming an ITC. Download form and document related to RMCD.

Within 90 working days after manual submission. Multiplying taxable purchases by 6 to arrive at the GST input tax amount. Be affiliated by the Approved Refund Agent.

GST shall be levied and charged on the taxable supply of goods and services. This guide includes everything you need to know about digital tax laws in Malaysia whether your customers live in Kuala Lumpur or Putrajaya. The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting.

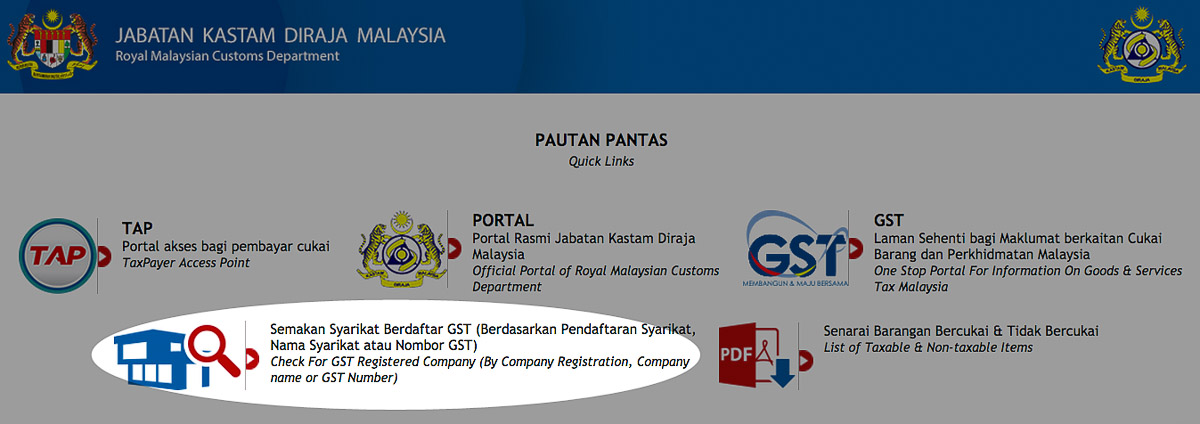

You can check by GST number Business name or the Business Registration number. Businesses are allowed to claim whatever amount of GST paid on the business inputs by offsetting against the output tax. GST refund of less than RM 100000 GST refund which is less than RM100000 would be paid back to the respective GST registrants if the GST refund claim passes the desk review verification process.

This is the first case of its kind in Malaysia where the scope of the GST Repeal Act 2018 in relation to input tax refund was examined by the High. Any refund of tax may be offset against other unpaid GST customs and excise duties. Amendment to final GST return due by 31 August 2020.

The two reduced SST rates are 6 and 5. KUALA LUMPUR June 15 The Finance Ministry through the Royal Malaysian Customs Department is committed to ensuring that the Goods and Services Tax GST refund to taxpayers will be expedited and payment to be made beginning June 22. There are two ways to get your money back.

The earlier taxation structure ie sales and service tax which was 5-15 was reduced to 6 by GST implementation in Malaysia. Directly follow up with the Customs officer to check on the refund status 1. To meet medium-term.

Goods and Service Tax in Malaysia is a single taxation system in the economy levied on all goods and services in the country. Malaysias goods and services tax GST was replaced by the sales tax and services tax but there are still transitional GST issues that may need to be resolved. GST claims on suppliers invoice denoted in foreign currency based on your own in-house.

By way of background the goods and services tax GST regime in Malaysia was implemented on 1 April 2015. The High Court ruled that customs had erroneously rejected the taxpayers claim for an ITC refund. The GST refund can be paid in cash but only to maximum 300 MYR equivalent to 70 USD.

Refund will be made to the claimant within 14 working days if the claim is submitted online or 28 working days if the claim is submitted manually. Claiming your GST Refund Malaysia is not difficult but you need to know what to do before you make your purchases to ensure that you have your tax invoice from an approved sales outlet. Under Goods Services Tax GST system in Malaysia businesses with annual sales of RM500 000 or more are required to be registered under the GST.

GST refund of RM100000 or more GST refunds of RM RM100000 or more will need to go through a risk rating process. Featured Tax Refunds Travel Tips Useful Services. As a tourist visiting Malaysia how to claim a refund of GST paid on eligible goods purchased from an Approved Outlet As a business the conditions and eligibility requirements to become an Approved Outlet 2.

JUNE 28 The recent announcement made by the Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz that the Government will expedite the Goods and Services Tax GST refund to ease the cash flows of businesses during this trying time is applauded. Thats what this guide is for. If your business annual sales do not exceed this amount you are not obliged to register for GST.

Omission of 6 GST on the disposal of fixed assets or trade-in of assets within Malaysia. The standard goods and services tax GST in Malaysia is sales and service tax SST of 10. 7 November 2017.

The taxpayer was awarded the ITC refund with 8 interest running from the date the refund was due. No attribution of input tax incurred for exempt supplies or non-business activities. Have not received your Tax Refund.

Claiming GST Refunds. The refund will be paid back to your credit card within 5 days. The IRBM Clients Charter sets that tax refund will be processed within 30 working days after e-Filing submission.

Be registered for GST under section 20 GST Act 2014 and hold a valid GST registration number. In order to participate in the Tourist Refund Scheme in Malaysia a Merchant must-. All the goods and services offered in the country would be charged at 6 tax.

It applies to most goods and services. No matter where you live or where your online business is based if you have customers in Malaysia you gotta follow Malaysian GST rules. Only businesses registered under GST can charge and collect GST.

He said the Royal Malaysian Customs Department RMCD will employ pay first and audit later.

Gst Registration Pan India Registration Goods And Service Tax Goods And Services Registration

How To Get Tax Free Shopping In Singapore Living Nomads Travel Tips Guides News Information Singapore Shopping Mall Tax Free Shopping

Alexandra On Instagram Duty Free And Tax Refund Money New Big Fat Bff

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

Tax Return Thornton Indirect Tax Credit Card Companies Tax

Guide To Gst Refund In Australia Bragmybag

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller

Thailand Introduces Blockchain Based Tax Refunds For Oil Exporters Commercial Bank Blockchain Tax Refund

Create The Perfect Design By Customizing Easy To Use Templates In Minutes Easily Convert Your Image Designs Into Vid Tax Preparation Tax Refund Tax Consulting

Chicago Property Taxes Hit Poorest Disproportionately Tax Debt Tax Attorney Tax Accountant

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Como Economizar Dinheiro Simbolo De Libra Graficos Financeiros

Gst Rates In Malaysia Explained Wise

How To Get Gst Tax Refund Before Leaving Singapore Changi Airport Or Cruise Terminal Understand What Is Gst Sal Singapore Changi Airport Singapore Travel Tips

Money Network Money Management Tax Refund Prepaid Card

Claiming Your Gst Refund As You Leave Malaysia Trs Economy Traveller